In a world running with digital innovations, the spotlight is on the next big generation in finance – cryptocurrencies. As the traditional financial landscape undergoes a major transformation, the charm of decentralized digital currencies, led by the trailblazer Bitcoin, has captured the interest of investors worldwide.

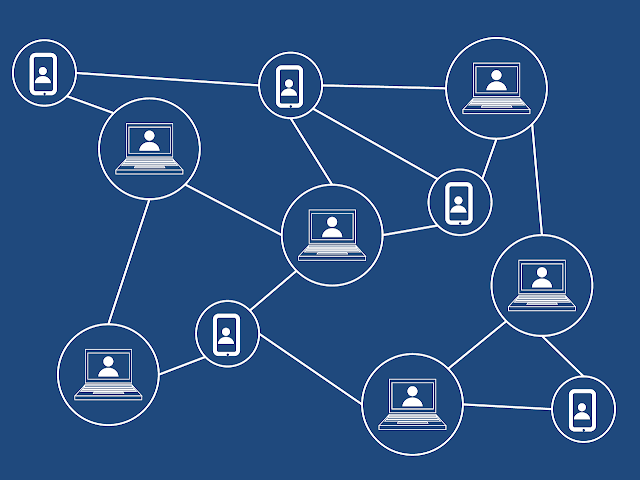

Cryptocurrency investments usher in a new era of finance, challenging the norms of traditional banking and investment. Unlike regular currencies controlled by big institutions, cryptocurrencies operate on the magic of blockchain technology – a decentralized ledger ensuring transparency, security, and immutability.

When you invest in cryptocurrencies, you're essentially getting digital assets, hoping they'll grow in value over time. Bitcoin, the pioneer that kicked off this revolution in 2009, paved the way for a host of other important coins. Each of these coins comes with its own unique features, projects, long and short-term goals, and purposes, making the crypto world a dynamic and fascinating space.

But before anything let's ask an important question:

Why Cryptocurrency Investments Matter:

Cryptocurrency clearly will be the next generation of the economical deals between all people, even now, some international sites already started dealing with some Cryptocurrencies as a way of paying for their products. So, you must know how it matters to you to invest in Cryptocurrencies before you miss that trend.

1. Financial Inclusion:

Cryptocurrencies have the power to include individuals traditionally excluded from traditional banking systems, providing financial services to the un-banked & under-banked.

2. Decentralization:

The absence of central authorities in cryptocurrency networks fosters a trust-less environment, where transactions occur directly between users & without the need for intermediaries or mediators.

3. Global Accessibility:

Cryptocurrencies crash all borders, allowing investors like you and me to easily participate in a global financial market without the constraints of traditional banking hours or geographical limitations.

Here, it's my turn to spot the light on your mind to tell you about the first kick start cryptocurrency coin, and tell you how to invest on it.

I will divide this blog in simple points to start understanding about bitcoin. First of all:

How does Bitcoin work ?

This will be the 1st traditional question you will get before investing a pinny in bitcoin. This question often surrounded by confusion, so here's a quick explanation!

Bitcoin basics for new users

If you're new to Bitcoin, you don't need to delve into the technical stuff right away. Once you've got a Bitcoin wallet on your computer or phone, it will make your first Bitcoin address. You can make more whenever you want. Share your addresses with friends for payments or get theirs. It's a bit like how email works, just remember to use Bitcoin addresses only once.

Balances - block chain

Think of the blockchain like a giant, shared public ledger that the whole Bitcoin network depends on. Every confirmed transaction gets recorded in this ledger. It helps Bitcoin wallets figure out how much they can spend, making sure new transactions are valid and really belong to the person spending. The blockchain's security and order come from clever use of cryptography. This technology offer more security way to send & receive your money without need of massive layers of hard actions.

Transactions - private keys

A transaction in the world of Bitcoin is like moving value between wallets, and it gets written into the big blockchain. Bitcoin wallets have a secret code called a private key (sometimes it called seed).

This code is like their signature in the real world, proving the owner is making the transaction. The signature also makes sure no one can change the transaction once it's done. When you send a transaction, it goes out to the network and usually gets confirmed in about 10-20 minutes through a process called mining. So as you can see, for not losing your money, make sure that the transaction is alright and you know where you will send to who, as it's a one way transaction.

Processing - mining

For anything to be legit, and can be done alright without problems, and at the same time has a real value, it will need an effort, a pay for it (not as a money) but as an observation of it. In the world of cryptocurrencies, this observation is knows as mining.

Mining is like a team effort to make sure transactions in the blockchain are legit. It puts transactions in order, keeps the network fair, and helps computers agree on what's happening. To get the green light, transactions must follow strict rules and be packed into a block. The network checks this block to make sure everything's secure. The rules also stop anyone from messing with previous blocks because that would mess up everything after. Mining also adds a bit of excitement, like a competitive lottery, making it tough for one person or group to control the whole blockchain. This way, no one can play tricks and change what's in the blockchain or undo their spending.

For future blog, I will tell you in details, how you can easily invest in bitcoin assets in simple way step by step guide.